11. Which of the Following Best Describes Term Life Insurance

During this time the policy face amount was increased to 150000. The insured pays a premium for a specified number of years.

What Is A Risk Register A Project Manager S Guide With Examples Asana

The insured can borrow or collect the cash value of the policy.

. Term insurance is paid over a short period of time such as 1 time a. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. C It is level term insurance.

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. The insured pays the premium until his or her death. 3 correct statements regarding credit life insurance.

C an option to convert provides that a term life insurance policy can be exchanged for a. Group term life insurance is an employee benefit thats often provided for free by employers. And these costs can be from 100 to several tens or.

The insured pays a premium for a specified number of years. The insured can borrow or collect the cash value of the policy. The amount of insurance permissible is limited per borrower.

Benefits are paid to the creditor. Term life insurance is typically sold in lengths of one five 10 15 20 25 or 30 years. Which of the following best describes term life insurance.

The insured is covered during his or her entire lifetime. Coverage amounts vary depending on. Term life insurance allows you to save money and place it into other accounts that will grow.

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Probability of dying increasing as you grow older. Which of the following best describes term life insurance is a tool to reduce your risks.

Is a tool to reduce your risks. Which of the following best describes annually renewable term insurance. Life insurance can be Term or Whole Life.

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. In reality its financial health is terrible and the company will soon have to file bankruptcy. The insured is covered during his or her entire lifetime.

All of the following statements regarding annuities are correct EXCEPT. Which of the following terms best describes the advertisement. Which of the following best describes annually renewable term insurance.

It is a level term insurance. A a 3-year renewable policy allows a term policyowner to renew the same coverage for another 3 years. With answer 4 a whole-life or universal life policy both offer a cash-value savings account that is tax deferred.

If the insured dies during the time period specified in the. Dying before financial obligations have been met. See the answer See the answer done loading.

B It provides an annually increasing death benefit. A man decides to purchase a 100000 annually renewable term insurance life policy to provide additional protection until his children finished college he discovered that this policy. Neither the premium nor the death benefit is affected by the insureds age.

21- Which of the following best describes what life insurance is designed to protect against. At one time the cash value exceeded 100000 and was worth 150000. A Neither the premium nor the death benefit is affected by the insureds age.

In the following year the cash value took a significant decline and was worth only 70000. In CA Haven Term is DTC-CA 042017. This means that youll slowly.

Haven Term is a Term Life Insurance Policy DTC and ICC17DTC in certain states including NC issued by Massachusetts Mutual Life Insurance Company MassMutual Springfield MA 01111-0001 and offered exclusively through Haven Life Insurance Agency LLC. Which of the following statements is correct for term insurance. Which of the following best describes term life insurance.

B a 3-year renewable policy allows a term policyowner to increase coverage for the next 3 years. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. The insured can borrow or collect the cash value of the policy.

Which of the following best describes term life insurance. In NY Haven Term is DTC-NY 1017. The insured pays the premium until his or her death.

In credit life insurance the creditor is the beneficiary for the amount of benefit equal to the outstanding balance of the loan. Which of the following best describes term life insurance. An insured has a variable life policy with a 100000 face amount.

The insured pays a premium for a specified number of years. It provides annually increasing death benefit. The choice that best describes term life insurance is.

View Test Prep - FINAL QUIZ_-104 from ECON 113 at Harvard University. Term life insurance allows you to save money and place it into other accounts that will grow. It requires proof of insurability on each renewal.

Which of the following best describes term life insurance. The insured pays the premium until his or her death. Premiums for term insurance remain constant.

April 11 2022 Enter All These Gifts Cards For The Best Chance Of Winning Life And Health Insurance Whole Life Insurance Life Insurance Quotes Pin On 7esl Learning English. All of the following statements regarding term life insurance are correct EXCEPT. Premiums are usually paid by the borrower.

And these costs can be from 100 to several tens or. The insured pays the premium until his or her death. How it works.

And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. Neither the premium nor the death benefit is affected by the insureds age. A generally annuity contracts issued today require fixed level funding payments B annuities are sold by life insurance agents C an annuity is a periodic payment D annuitants can pay the annuity premiums in lump sums.

Employees may also have the option to buy additional coverage through payroll. The insured is covered during his or her entire lifetime. Depending on the contract other events such as terminal illness or critical illness can.

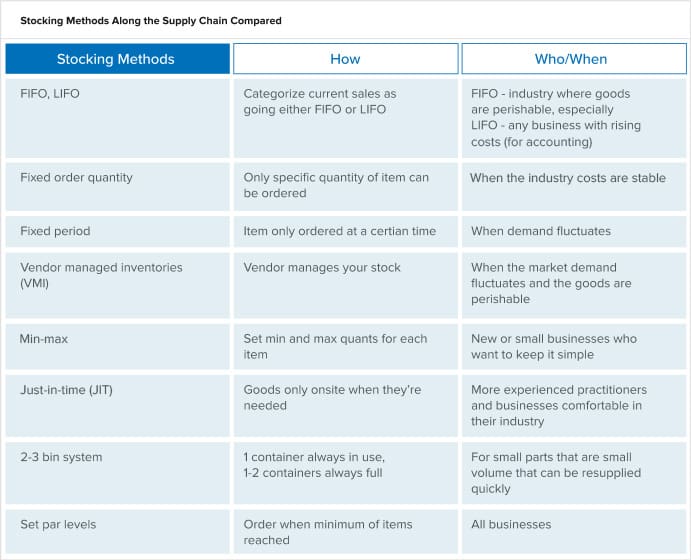

Inventory Control Defined Best Practices Systems Management Netsuite

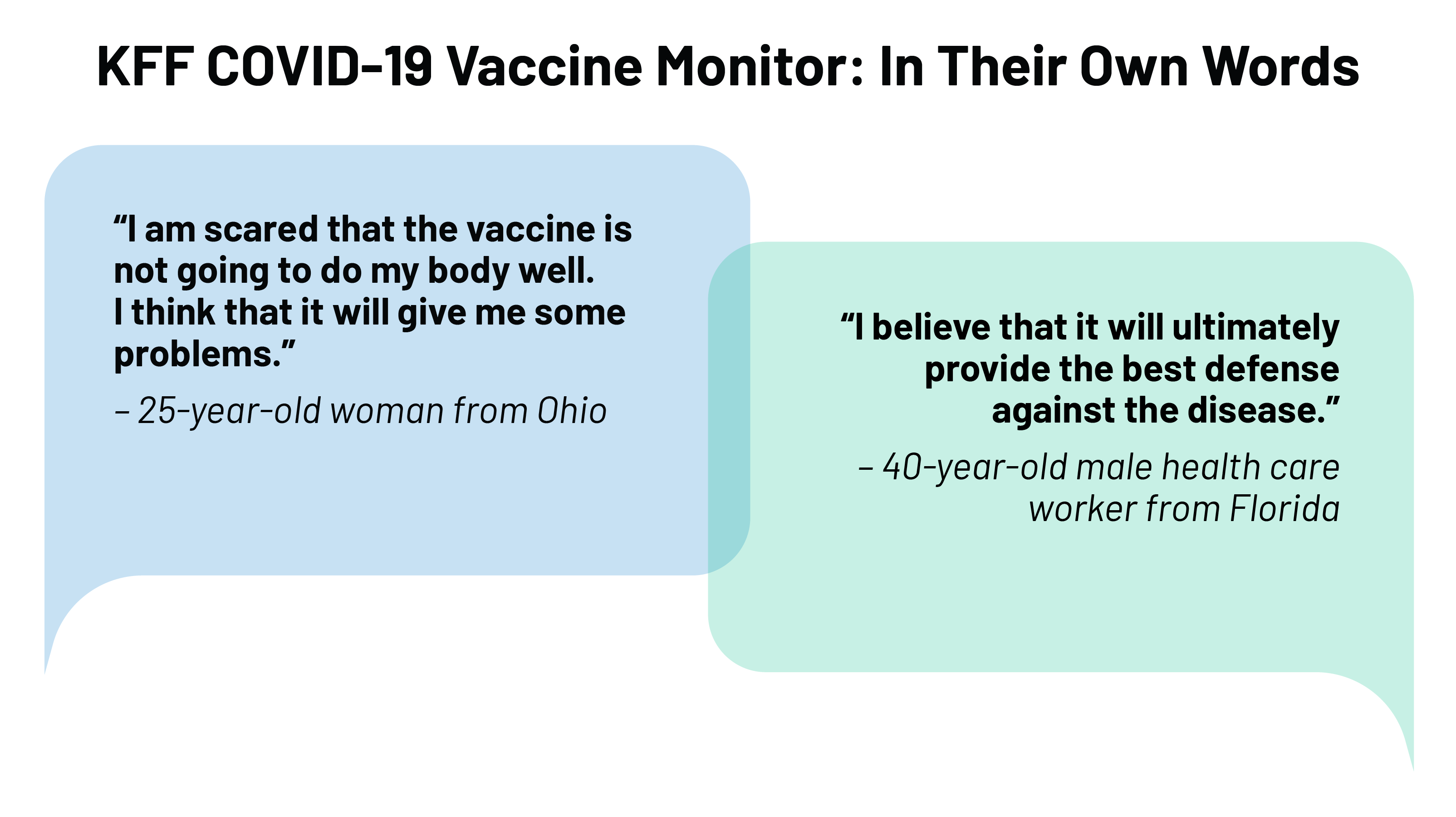

Kff Covid 19 Vaccine Monitor In Their Own Words Six Months Later Kff

Osi Model The 7 Layers Of Network Architecture Bmc Software Blogs

Solving Linear Equations And Linear Inequalities Basic Example Video Khan Academy

No comments for "11. Which of the Following Best Describes Term Life Insurance"

Post a Comment